Call us @+234 806 558 2598

Elon Musk $29 Billion Payday

Elon Musk Tesla’s Big Bet on a Bold Future

In a world where CEOs typically cash out with bonuses and golden parachutes, Tesla’s Elon Musk plays by a very different set of rules, and the stakes have never been higher. The Tesla board just unveiled a massive new pay package for Musk, valued at a staggering $29 billion, reaffirming its faith in a man who has made disruption his brand and transformation his currency.

But this isn’t your everyday executive payday. This is high-stakes Silicon Valley capitalism, wrapped in legal drama, political friction, and a bold pivot from electric vehicles to artificial intelligence and robotics. Let’s unpack what’s happening, and why the world is watching closely.

The Return of the 2018 Pay Package

To understand Musk’s new compensation, we have to go back, to 2018, when Tesla offered him a groundbreaking performance-based pay plan worth tens of billions. That deal, approved by shareholders, awarded Musk 96 million stock options if he hit aggressive growth milestones. He did.

Tesla’s market cap skyrocketed. Revenue and production soared. Musk, in turn, became one of the richest individuals in history. But not everyone was impressed. Earlier this year, a Delaware judge threw out that pay package after a shareholder lawsuit alleged the board wasn’t truly independent when the deal was struck. Tesla has been fighting to reinstate it ever since and Musk is appealing the ruling.

Now, the board is effectively offering him that deal again: 96 million shares at $23.34 each, while the stock currently trades north of $300. That’s not just a payday, that’s a vote of confidence during turbulent times. In a letter to shareholders, board members Robyn Denholm and Kathleen Wilson-Thompson didn’t hold back: “Despite these legal challenges, we can all agree that Elon has delivered the transformative and unprecedented growth that was required to earn all milestones of the 2018 CEO Performance Award. This growth has translated into immense value generated for Tesla and all our shareholders.”

No Salary, No Bonus — Just Risk and Reward

Unlike most executives, Musk doesn’t draw a salary or cash bonus from Tesla. His compensation is entirely equity-based, a structure that ties his earnings directly to the company’s long-term performance.

And make no mistake, Tesla isn’t handing him free shares. If Musk accepts the package, he must purchase the stock options at a fixed price of $23.34 per share, a sum totaling more than $2.2 billion out of pocket, to unlock their true value. That’s an expensive bet, even for a billionaire. But if Tesla rebounds, it’s one that could pay off handsomely.

Political Distractions, Public Backlash, and Tumbling Shares

Yet not everything Musk touches turns to gold.

Over the past year, he’s attracted criticism, not for innovation, but for politics. Musk threw his weight behind Republican candidates, pouring money and attention into America’s election season. While he was successful in influencing outcomes, the move didn’t sit well with everyone.

Protests erupted at Tesla dealerships. Public perception soured. More worryingly, Tesla’s core business — electric vehicles — began to stumble. The company’s sales have dropped significantly in 2025. And Washington didn’t help either: under President Trump’s new policy agenda, tax credits for EV buyers have been stripped away, along with regulatory credits Tesla often sells to other automakers. These incentives have been major contributors to Tesla’s bottom line.

The result? Tesla shares are down 25% this year. That context makes Musk’s new pay package even more controversial and more strategic. It’s not just about rewarding past success. It’s about keeping Musk focused on Tesla, and out of politics.

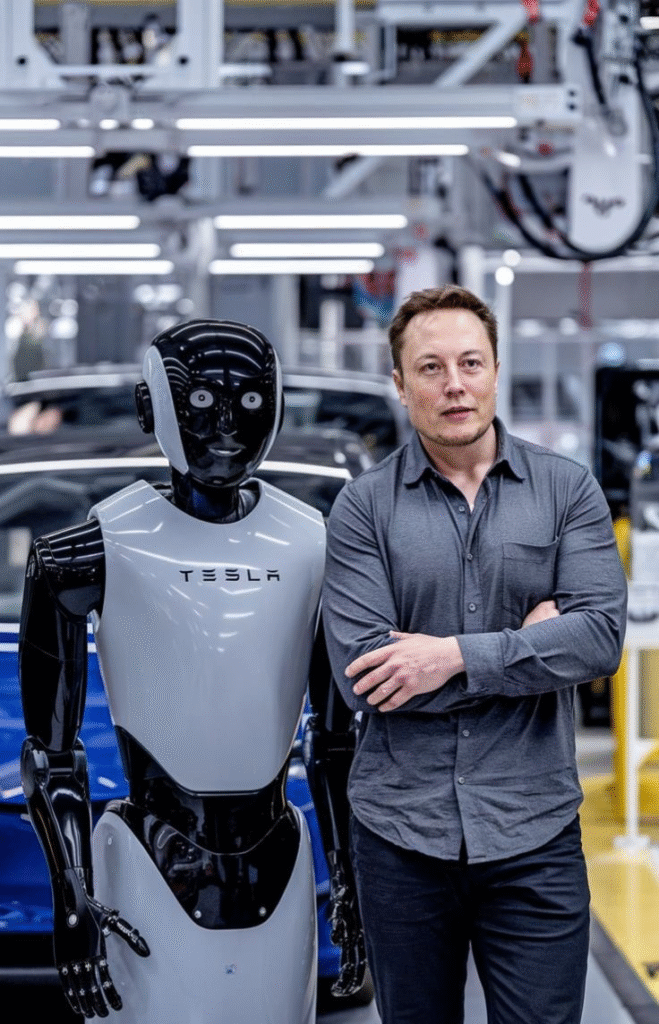

Tesla’s AI & Robotics Reinvention: A New Musk Mission

So where does Tesla go from here? In a word: robots. Elon Musk has never hidden his belief that Tesla is more than just a car company. But now, he’s putting that vision into action. The new strategy centers on artificial intelligence, autonomous systems, and robotics, with electric vehicles becoming just one piece of the puzzle.

According to Denholm and Wilson-Thompson: “Through Elon’s unique vision and leadership, Tesla is transitioning from its role as a leader in the electric vehicle and renewable energy industries to grow towards becoming a leader in AI, robotics and related services.”

One example? The long-anticipated Tesla Robotaxi which, while launching on a more modest scale than Musk initially promised, represents Tesla’s next frontier. The pivot is ambitious, risky, and characteristic of Musk’s appetite for reinvention. But it’s also necessary. The EV market is becoming crowded and politically volatile. By moving into AI and robotics, Tesla is seeking not just to survive, but to redefine itself entirely.

What Comes Next?

Whether you love or loathe Elon Musk, one thing is clear: his leadership has fundamentally reshaped Tesla and the entire automotive landscape. From battery tech to supercharging networks to mainstreaming electric vehicles, Musk’s bets have largely paid off, until recently.

This $29 billion pay package is about much more than money. It’s a challenge. A dare. A statement that says: If anyone can pull Tesla out of its current dip and transform it into a tech titan of the future, it’s Elon. But with legal hurdles, political distractions, and a rapidly changing market ahead, the pressure is immense. Musk is now being asked not just to innovate, but to focus. To deliver. To lead.

The question isn’t just whether he deserves the money. It’s whether he can earn it again, this time, not by changing how we drive, but by shaping the future of how we live and move in a world of machines, algorithms, and autonomy. So buckle up. The next chapter of Tesla is being written. And like everything Musk touches, it’s guaranteed to be anything but boring.

For more sharp takes on trending tech, politics, and business moves, stay tuned to UpandTrending.com — where the headlines don’t just break, they spark debate.