Call us @+234 806 558 2598

Elon Musk, The World’s First Trillionaire to Be

Tesla’s Bold Gamble: Could Elon Musk Become the World’s First Trillionaire?

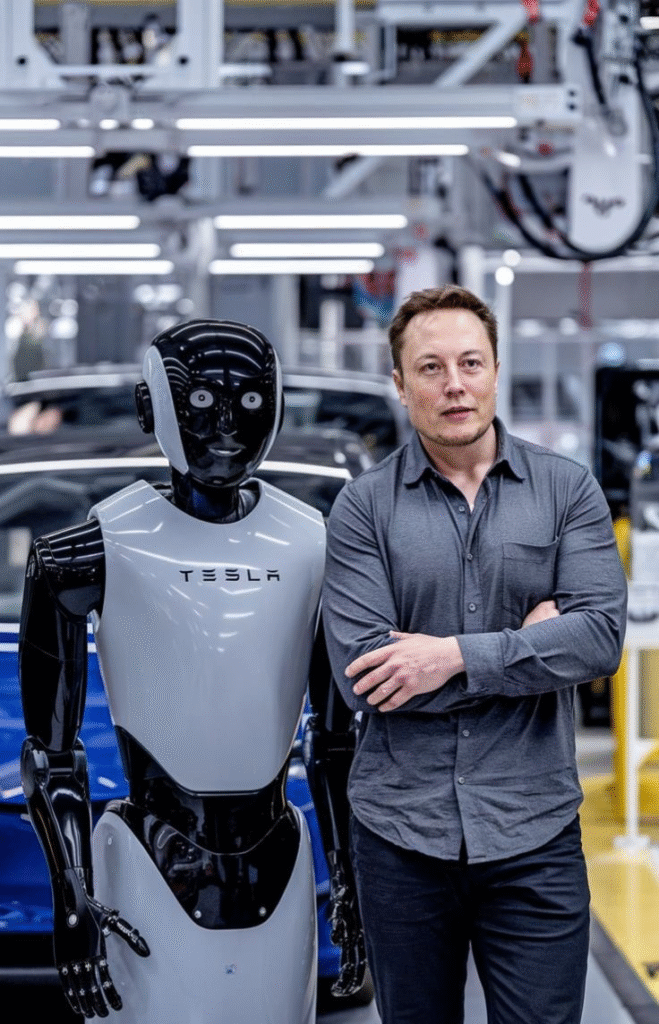

Elon Musk has never been a stranger to bold bets. From rockets to self-driving cars to humanoid robots, he has consistently positioned himself as a man willing to risk it all for the future. Now, Tesla has unveiled a new pay package for its CEO, one so massive that it could make Musk the world’s first trillionaire.

The deal is more than just numbers on paper. It represents Tesla’s attempt to keep its mercurial leader focused on the company’s long-term mission, even as he juggles multiple empires, from SpaceX to xAI to his ever-turbulent ownership of X (formerly Twitter).

ALSO READ: Elon Musk $29 Billion Payday

But is this pay package genius, madness, or perhaps a bit of both?

A Trillionaire in the Making

Tesla’s board has proposed awarding Musk up to 423.7 million additional shares if the company reaches sky-high growth targets. At today’s value, those shares are worth $143.5 billion, but that’s just the beginning. If Tesla achieves a market capitalization of $8.5 trillion, those shares alone could be worth close to $1 trillion.

For context, Tesla’s current market cap sits around $1.1 trillion. That means the company would need to grow more than sevenfold to unlock Musk’s payday. To put it in perspective, Tesla would need to become worth twice as much as Nvidia, currently the world’s most valuable company. Ambitious? Absolutely. Impossible? Well, Elon Musk has a history of turning the “impossible” into his personal playground.

Tesla’s board was blunt in its proxy statement: the company must incentivize Musk to stay focused. Despite being Tesla’s most valuable asset, Musk is also its greatest distraction. Between running SpaceX, developing AI at xAI, dabbling in politics, and occasionally sparring with world leaders on X, there’s always a question of whether Tesla is his top priority.

Dan Ives, a well-known Tesla bull from Wedbush Securities, summed it up perfectly: “It’s a big pay package, but Tesla needs to keep its biggest asset in Musk as CEO. In this AI era, Musk now will drive its next leg of growth.” The board also made it clear they’re preparing for life after Musk. One condition of the new package is that he must develop a framework for CEO succession, a nod to the fact that even the world’s most ambitious entrepreneur won’t be around forever.

Interestingly, Tesla’s proxy statement also mentioned a shareholder proposal for the company to invest in xAI, Musk’s privately held artificial intelligence venture. Why does this matter? Because xAI is the same company that recently absorbed X (formerly Twitter), which Musk famously purchased for $44 billion in 2022. Any Tesla stake in xAI would not only consolidate Musk’s sprawling empire but also potentially enrich Tesla shareholders, though details of such an investment remain vague.

Still, it raises a big question: is this about Tesla’s growth, or about strengthening Musk’s influence across industries?

The Challenges Ahead

For Musk to cash in, Tesla needs to do far more than simply sell more cars. The package ties his payout to audacious operational milestones, including:

- Launching a fleet of robotaxis that could generate massive recurring revenue.

- Deploying a million humanoid robots, a futuristic vision that could eclipse Tesla’s auto business.

- Raising Tesla’s adjusted operating income to $50 billion, nearly triple its best year so far.

But skeptics argue that Musk has a track record of overpromising. He’s been saying since 2014 that fully autonomous vehicles are “just around the corner,” yet the dream has remained just that. Critics like analyst Gordon Johnson are blunt: “Is Tesla going to $8 trillion? Abso-f**king-lutely not.” Add to that growing competition from Chinese EV giants like BYD, shrinking regulatory credit revenue, and political controversies, and the road to $8.5 trillion looks more like a minefield than a highway.

One key detail often overlooked is Musk’s insistence on 25% control of Tesla. Currently, he owns about 13% of the company, even after accounting for options. In Musk’s own words: “I am uncomfortable growing Tesla to be a leader in AI & robotics without having ~25% voting control. Enough to be influential, but not so much that I can’t be overturned.”

Translation? Musk wants insurance against being sidelined by shareholders, or, as some critics argue, against being “kicked out.” This makes the new pay package not just about compensation, but about power. Supporters see the package as a brilliant move to keep Musk locked in on Tesla’s future. Detractors call it corporate greed on steroids. Ross Gerber, once a Tesla fan, didn’t mince words: “If he hits the targets, then in some ways it’s warranted. But it goes back to what level of greed can you reach in a modern society that’s enough.”

In other words, this package forces us to ask: how much is too much for one man, even if that man might be the most influential entrepreneur of our time?

Whether you admire Elon Musk as a visionary or view him as a manipulator, one thing is clear: Tesla’s proposed pay package is one of the boldest corporate gambits in history. If Tesla hits the mark, Musk could go down as not only the world’s first trillionaire but also as the CEO who reshaped entire industries, energy, transportation, AI, and robotics. But if Tesla stumbles, this could be remembered as a case study in unchecked ambition and corporate excess.

For now, Wall Street is watching closely, critics are sharpening their knives, and Musk, true to form, is promising a future that sounds like science fiction. The only question is: will Tesla investors buy into the dream again?

Elon Musk the trend maker number one